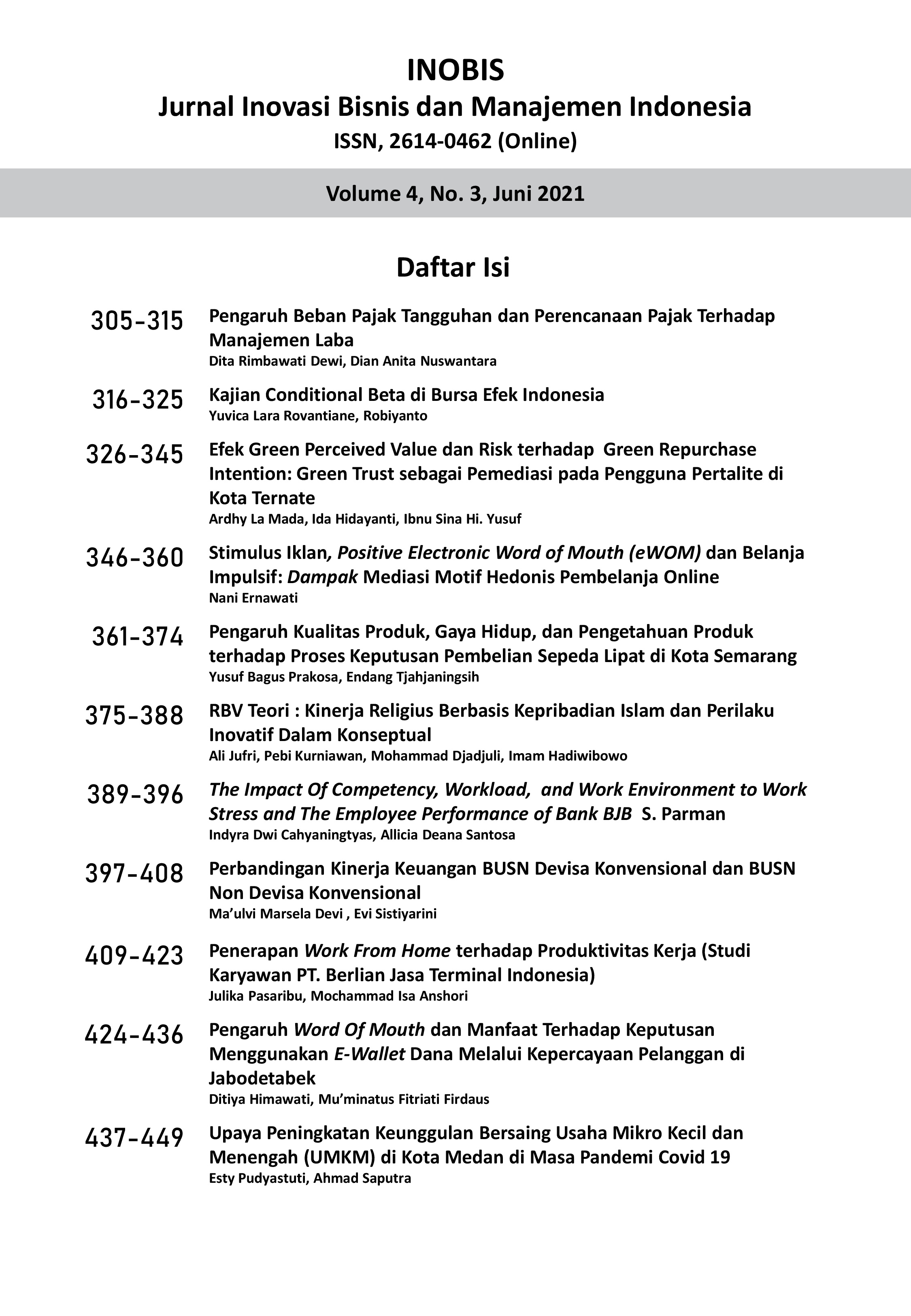

Pengaruh Beban Pajak Tangguhan dan Perencanaan Pajak Terhadap Manajemen Laba

DOI:

https://doi.org/10.31842/jurnalinobis.v4i3.185Keywords:

Deferred Tax Expense, Tax Planning, Earning Management, Consumer Goods IndustryAbstract

This study aims to examine the effect of deferred tax expense and tax planning on earnings management. This research is a quantitative study using secondary data from financial reports and annual reports of manufacturing companies sub-sector consumer good indutry listed on the Indonesia Stock Exchange from 2014 until 2018. The sample selection uses a purposive sampling method. Data analysis techniques using multiple regression analysis with SPSS 23. The results of this study are the variable tax planning has a positive influence on earnings management. The variable deferred tax expense does not have a significant effect on earnings management because management has limitations in determining the amount of deffered tax expense.