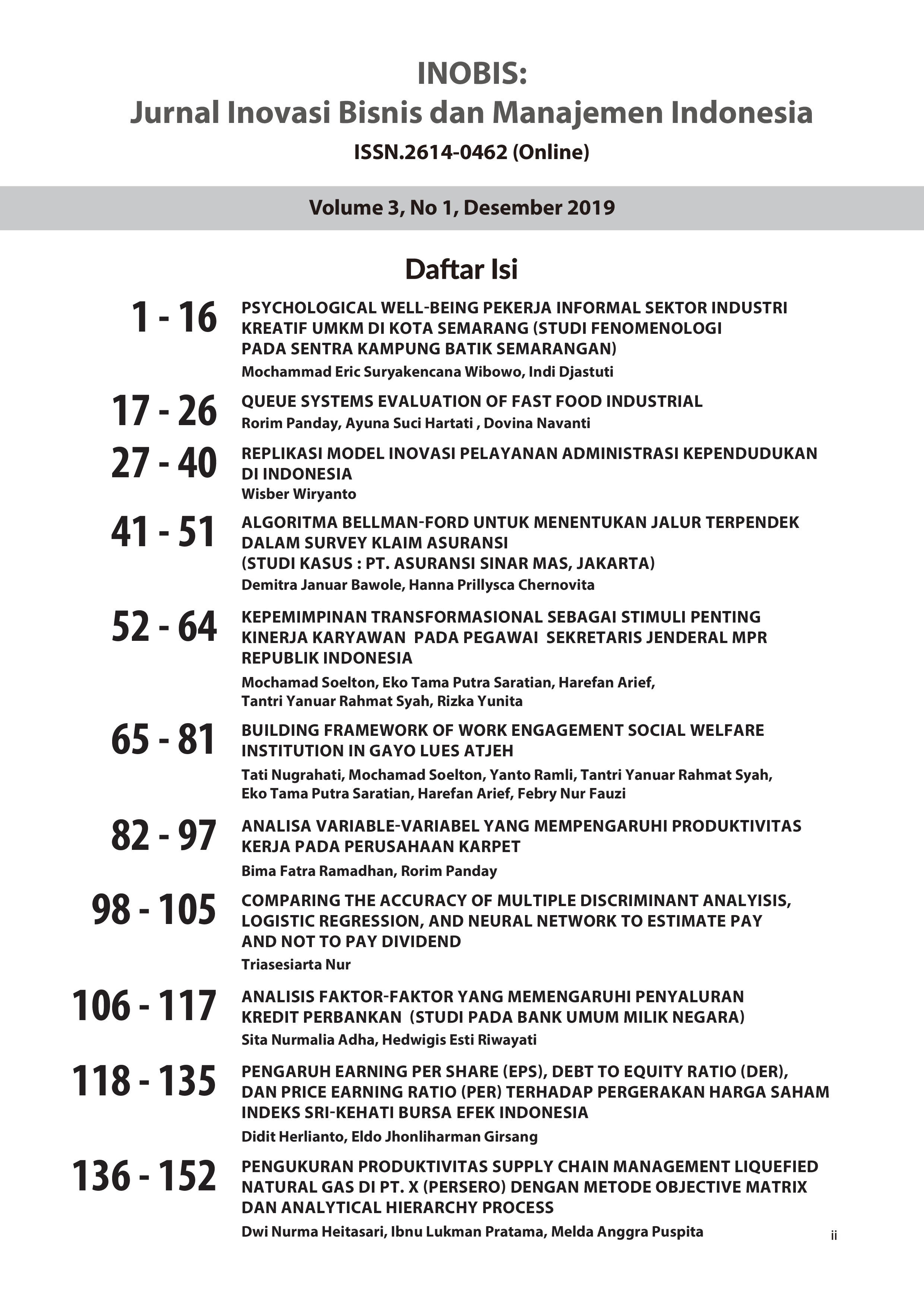

Pengaruh Earning Per Share (EPS), Debt To Equity Ratio (DER), Dan Price Earning Ratio (PER) Terhadap Pergerakan Harga Saham Indeks SRI-KEHATI Bursa Efek Indonesia

DOI:

https://doi.org/10.31842/jurnal-inobis.v3i1.125Keywords:

Earning Per Share (EPS), Debt to Equity Ratio (DER), Price Earning Ratio (PER), Stock PricesAbstract

This study aims to determine and analyze the effect of Earning Per Share (EPS), Debt to Equity Ratio (DER), and Price Earning Ratio (PER) on the movement of stock prices in the Sri Kehati Index of the Indonesia Stock Exchange in the period of 2016-2018. The sampling technique used in this study was purposive sampling, with the criteria that the company was listed consecutively in the Sri Kehati index on the Indonesia Stock Exchange for the period 2016-2018 and submitted audited financial information published on the Indonesia Stock Exchange data base during the 2016- 2018. From purposive sampling according to the criteria that have been determined in this study, it was found 22 companies as the research sample from a population of 25 companies. The data analysis technique used is multiple regression. The results show that Earning Per Share (EPS), Debt to Equity Ratio (DER), and Price Earning Ratio (PER) have a positive effect on stock prices, Earning Per Share (EPS) has a positive effect on stock prices, Debt to Equity Ratio (DER) ) has a positive effect on stock prices, Price Earning Ratio (PER) has a positive effect on stock prices.